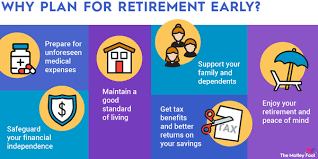

Retirement may seem like a distant dream for many, but the key to ensuring a comfortable and financially secure future is starting early. The sooner you begin saving for retirement, the better prepared you will be when the time comes. However, the approach to saving for retirement varies depending on your age group, as each stage of life comes with unique challenges and opportunities.

Whether you are in your 20s, 30s, 40s, 50s, or nearing retirement, understanding how to optimize your retirement savings strategy can make a significant difference in your financial future. In this article, we will provide expert tips on how to save for retirement, tailored to each major age group.

1. Saving for Retirement in Your 20s: Starting Early Pays Off

Why It’s Important:

When you’re in your 20s, retirement might feel like a far-off concern. However, this is the best time to start saving because of the power of compound interest. The earlier you start, the more your savings will grow over time.

Expert Tips:

- Start with an Emergency Fund: Before jumping into retirement savings, ensure you have a solid emergency fund. Aim for three to six months’ worth of living expenses in a high-yield savings account. This fund will help prevent you from dipping into your retirement savings in case of unexpected events.

- Take Advantage of Employer-Sponsored Retirement Accounts: If your employer offers a 401(k) match, contribute enough to take full advantage of this “free money.” Even if you can’t max out your contributions, every dollar you contribute is a step toward a secure retirement.

- Open an IRA (Individual Retirement Account): A Roth IRA is a great option for young people because it allows tax-free withdrawals in retirement. If you earn less now, contributing to a Roth IRA can save you money in taxes later.

- Automate Your Savings: Set up automatic contributions to your retirement accounts. This will help you stay consistent and take advantage of dollar-cost averaging (DCA), which can reduce the impact of market volatility.

Goal: Save at least 15% of your income for retirement.

2. Saving for Retirement in Your 30s: Accelerating Your Savings

Why It’s Important:

By your 30s, you may have more financial responsibilities, such as buying a home, paying off student loans, or raising a family. While these are important priorities, your retirement savings should still be a top consideration. Time is still on your side, but you need to ramp up your contributions.

Expert Tips:

- Maximize Your Retirement Account Contributions: If possible, aim to contribute the maximum amount allowed to your 401(k) and IRA. In 2024, the contribution limit for a 401(k) is $22,500 (or $30,000 if you’re over 50), while the contribution limit for an IRA is $6,500 (or $7,500 if you’re over 50).

- Catch Up on Debt: While paying down high-interest debt, such as credit card balances, should be a priority, avoid neglecting your retirement savings. Consider consolidating or refinancing loans with lower interest rates to free up more funds for retirement.

- Diversify Your Investments: As your earnings grow, consider diversifying your investment portfolio to include stocks, bonds, mutual funds, ETFs, and real estate. A diversified portfolio helps mitigate risks and provides balanced returns.

- Consider a Health Savings Account (HSA): If eligible, open an HSA to save for healthcare expenses in retirement. Contributions to an HSA are tax-deductible, and withdrawals for qualified medical expenses are tax-free, making it a great addition to your retirement strategy.

Goal: Aim to save 15-20% of your income for retirement, focusing on higher contribution amounts and investment growth.

3. Saving for Retirement in Your 40s: Preparing for the Home Stretch

Why It’s Important:

In your 40s, retirement is starting to feel more real. The financial decisions you make now will have a significant impact on how comfortable you are in retirement. At this stage, your focus should be on maximizing your retirement savings while balancing other financial goals, such as college savings for children or paying down a mortgage.

Expert Tips:

- Catch-Up Contributions: If you haven’t been able to maximize your contributions in your 20s and 30s, your 40s is the time to catch up. Take advantage of catch-up contributions for both 401(k) and IRA accounts. The catch-up contribution for a 401(k) is $7,500, and for an IRA, it’s $1,000.

- Consider a Roth 401(k): If your employer offers a Roth 401(k), consider contributing to it. Roth 401(k)s allow for tax-free withdrawals in retirement, which is beneficial if you expect your income (and tax rate) to be higher in retirement.

- Rebalance Your Portfolio: As you get closer to retirement, your risk tolerance may change. Review your asset allocation to ensure it aligns with your retirement goals. Typically, a more conservative portfolio with a mix of stocks and bonds is recommended for those in their 40s.

- Plan for Healthcare Costs: Healthcare costs can be a significant expense in retirement. Consider contributing to an HSA (if eligible) or purchasing long-term care insurance to protect against future medical expenses.

Goal: Save 20-25% of your income for retirement, focusing on tax-efficient contributions and ensuring your portfolio is well-diversified.

4. Saving for Retirement in Your 50s: Maximizing Contributions and Minimizing Risk

Why It’s Important:

In your 50s, you may be nearing your peak earning years, and retirement is becoming a real and immediate concern. While you still have time to save, the strategies you implement now are critical to making up for any gaps in your retirement savings.

Expert Tips:

- Take Full Advantage of Catch-Up Contributions: In your 50s, you can contribute significantly more to retirement accounts. For 401(k)s, you can contribute up to $30,000, and for IRAs, you can contribute up to $7,500. Maximize these contributions to boost your retirement savings.

- Downsize Your Spending: This is the perfect time to review your expenses and cut back on discretionary spending. Redirect the money you save into your retirement accounts to make up for any shortfalls.

- Work With a Financial Advisor: Consult a retirement planner or financial advisor to create a strategy tailored to your specific financial situation. They can help you calculate how much you’ll need for retirement, develop a withdrawal strategy, and ensure your investments are on track.

- Consider Delaying Social Security: Delaying your Social Security benefits can significantly increase your monthly payment when you retire. If you can afford to wait until age 70, you can receive up to 8% more per year compared to starting benefits at age 62.

Goal: Save 25-30% of your income for retirement, focusing on making up for any past savings gaps and positioning your portfolio for growth and stability.

5. Saving for Retirement in Your 60s: Final Preparations Before Retirement

Why It’s Important:

In your 60s, the focus should shift from saving to ensuring your retirement nest egg is ready for use. This is the time to fine-tune your investment strategy, minimize risk, and prepare for the transition into retirement.

Expert Tips:

- Review Your Retirement Plan: Review your retirement savings, income sources, and projected expenses to ensure you have enough to cover your lifestyle. If you’ve delayed Social Security, decide when you’ll begin taking benefits.

- Optimize Asset Withdrawals: Start planning your withdrawal strategy. A common approach is the 4% rule, which suggests withdrawing 4% of your retirement savings annually. However, work with a financial advisor to tailor this strategy based on your specific needs.

- Consider Delaying Retirement: If you are not quite ready to retire, consider working a few more years to build up your savings and Social Security benefits. Every additional year of work can help you build a larger nest egg and delay the need to tap into your retirement funds.

- Plan for Long-Term Care: Long-term care expenses, such as nursing homes or home health care, can drain your savings quickly. Look into long-term care insurance or other options to protect your retirement savings from unexpected healthcare costs.

Goal: Ensure your retirement savings can sustain you for 30+ years and take steps to minimize taxes and risks.

Conclusion

Saving for retirement is a lifelong journey that requires careful planning, discipline, and strategic thinking. By starting early and adapting your savings strategy to your life stage, you can build a comfortable retirement fund that will support you in your later years. Whether you’re just starting in your 20s or preparing for retirement in your 60s, the key is to stay focused, maximize your contributions, and adjust your plan as needed. By following these expert tips for each age group, you can set yourself up for a financially secure future and retire with confidence.